Mulling It Over Before You Take the Leap

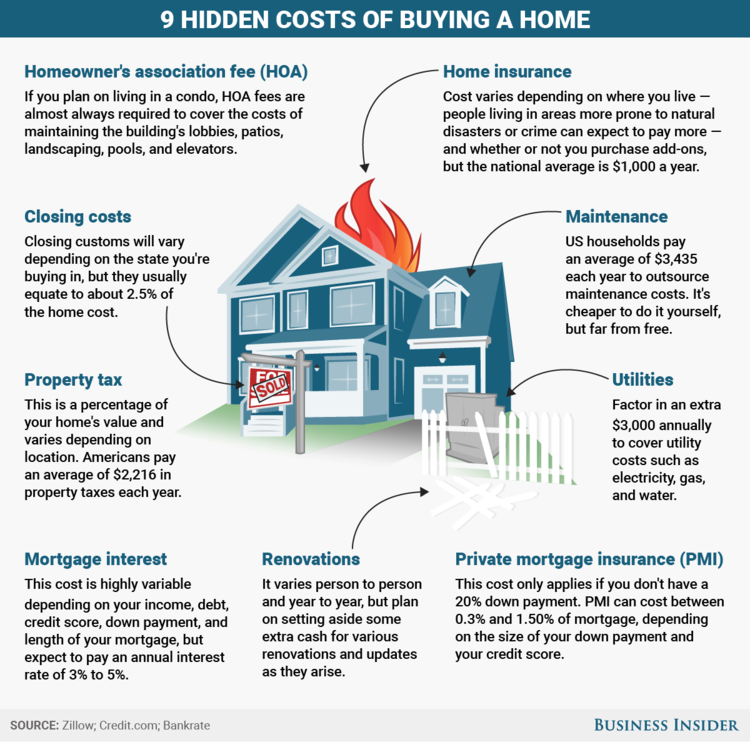

Assets put money in your pocket while liabilities take money out. According to this definition, buying a home might not be the best option. Every month, a homeowner must pay for mortgage, insurance, and utilities such as the water bill. In the case of a paid home, they will also spend money on maintenance, taxes, and insurance. A home will give a person a high net worth, but this money is not accessible to the homeowner. Someone that needs money will have to sell their home or refinance it.

Before investing in real estate, one must consider home value appreciation. If the purchase is done at the right time, appreciation can make your home an asset. The price of a home can double or triple in the span of thirty years; however, one should take note that during this time, a homeowner pays thousands of dollars in interest to banks (depending on the terms of sale of course), and there are also annual expenses for taxes and insurance. In addition to this, there are maintenance costs and repairs. When the home is sold, the increase in the home value price will be approximately the amount that was put into the home over the years of mortgage payments.

Purchasing an investment property will also require many payments; however, the person that will pay for these is the tenant. If you’re being stingy, you can buy a $100,000 place with a down payment of $20,000, and rent it out for the next 30 years. In this scenario, the tenant’s rent check should cover the cost of mortgage, taxes, insurance, repairs, and upgrades. Rent must be adjusted in order to stay ahead of inflation and the fees associated with property taxes. In this type of investment, the total return for your down payment will be a thousand percent or more. This means that over the span of thirty years, a property accumulated an annual return of 9.4%. If you receive more money each month than what it takes to own a home, the home will be an asset. In general, long-term housing investments generate between 13% to 15% per year. For short-term fix and flip investments, one must make sure that they can generate returns.

Experts advise that before giving a down payment on a home, it is important to think of your priorities. Decide whether the objective of buying a home is to increase your net worth or to raise a family. If investing is a priority, it is important to take note that there are other options to make money. According to Eric Roberge, a CFP and founder of Beyond Your Hammock, returns on the housing market will not make you rich. He states that homeowners are barely keeping up with inflation. A recent study by the London Business School and Credit Suisse showed that, excluding inflation, housing generated returns of 1.3% per year in the period between 1900 to 2011. In comparison, the average annualized total return for the S&P 500 index over the past 90 years was 9.8%.

Different lifestyles have different housing needs. The millennial generation, in particular, is a global society, and its members do not want to feel locked in to a location due to their mortgage. For millennials, it makes more sense to live in their ideal homes as renters. However, according to the National Association of Realtors, many millennials and Generation Zers are taking the leap of buying their first home. At 34%, millennials, people 36 and younger, are the largest share of all home buyers. Sixty-six percent of these people are first-time home buyers.

If you are interested in the real estate industry, a way to start small is by buying a duplex or house with a living unit or basement apartment. A homeowner can live in one unit and rent out the others; however, it is important to consider that you will be living with your tenant in the same home. Also, you should make sure that you are able to cover the entire cost of the mortgage without the additional rent payments. Later on in your career as a landlord and manager, you will be able to buy larger properties that have a greater earning potential. If you’re not able to purchase a house yet, it’s perfectly okay! It’s never too late to start saving up slowly by being stingy with your money. You’d be surprised at how much you can save by shopping at flea markets and thrift stores.